Race to Zero

Advances in technology continue to transform how our financial markets operate. The volume of financial products traded through computer automated trading taking place at high speed and with little human involvement has increased dramatically in the past few years. For example, today, over one third of UK equity trading volume is generated through high frequency automated computer trading while in the US this figure is closer to three-quarters.

Unfortunately, there is a downside.

[…] one strange and disturbing episode that lasted a mere 20 minutes on the afternoon of 6 May 2010, beginning around 2.40 p.m. The overall prices of US shares, and of the index futures contracts that are bets on those prices, fell by about 6 per cent in around five minutes, a fall of almost unprecedented rapidity (it’s typical for broad market indices to change by a maximum of between 1 and 2 per cent in an entire day). Overall prices then recovered almost as quickly, but gigantic price fluctuations took place in some individual shares. Shares in the global consultancy Accenture, for example, had been trading at around $40.50, but dropped to a single cent. Sotheby’s, which had been trading at around $34, suddenly jumped to $99,999.99. The market was already nervous that day because of the Eurozone debt crisis (in particular the dire situation of Greece), but no ‘new news’ arrived during the critical 20 minutes that could account for the huge sudden drop and recovery, and nothing had been learned about Accenture to explain its shares losing almost all their value.

On that day, the US equity market dropped by 600 points in 5 minutes, eliminating approximately US$800bn of value, and then regained almost all of the losses within 30 minutes. Wow.

After five months of investigation it was found that this “flash crash” was triggered by an algorithm used in an automated trading programme. Fortunately the electronic platform on which these trades were executed had a “stop logic” functionality designed to detect and interrupt such self-feeding crashes by giving human traders time to assess what was happening, step in and pick up bargains.

Algorithmic trading, including high frequency trading (HFT), is rapidly replacing human decision making, according to a UK government panel which warned that the right regulations need to be introduced to protect stock markets. The Government Department for Business, Innovation and Skills (BIS) has released a very good paper documenting this phenomenon. If you want a deeper view on this subject, it is definitely worth to give it a look: The Future of Computer Trading in Financial Markets | Working paper (pdf file)

The impact of technology developments

On the tech side, the impact is huge as well. Automated trading involves a bunch of time-critical aspects. Moreover, future trading machines will be able to adapt and learn with little human involvement in their design. There is a compelling article on HPCWire addressing this issues and, again, my advice would be to go through it.

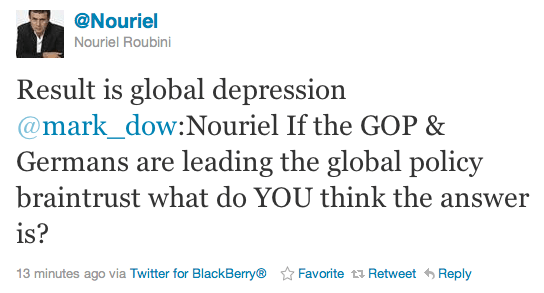

Nouriel Roubini

Nouriel Roubini